Trajectories of Trade and Investment Globalization

Christopher Chase-Dunn, Andrew Jorgenson

Institute for Research on World-Systems

https://irows.ucr.edu

College Building South

University of California-Riverside

Riverside, CA. 92521-0419

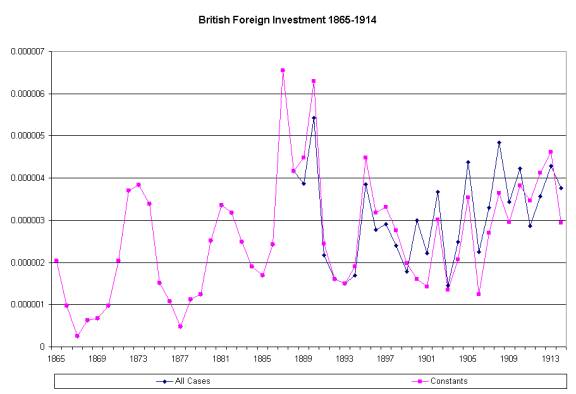

Appendix A: Yearly Non-net British Foreign Investment

Flows, 1862-1914

Our best yearly estimate so far of investment globalization in the nineteenth century comes from Irving Stone’s (1999) new study. This is a much-improved basis for estimating the trajectory of investment globalization in the nineteenth century because it does not rely on net figures. We have used Stone’s estimates of total private capital exports (flows) from the United Kingdom to thirteen countries (Argentina, Australia, Canada, Chile, Germany, Spain, France, India, Italy, Japan, Mexico, United States and South Africa) in pounds stirling and national income estimates in country currencies (converted into British pounds using exchange rates). These have then been weighted by the ratio of the country’s population to the world population and then the average for all the countries available for each year have been calculated with Figure 8 as the result.

Figure 8: Investment Globalization Based on British Private Capital Exports, 1865-1914

The method used in Figure 8 to produce yearly estimates of investment globalization is based on flows, the average amount of capital exported from Britain each year rather than on estimates of the total book value of British capital within each country. This may contribute to the volatility of the values, but the upward and downward trends seem to track the ten-year business cycle fairly closely. Interestingly the Great Depression that began in 1873 initiated a fall of capital exports that was no deeper than the previous decadal downturn, and in 1885 a steep ascent began that reached the highest peak of the whole period. From these data it appears that investment globalization has a similar trajectory to that of trade globalization in the nineteenth century. Recall that the trajectory of trade globalization in Figure 1 above has been transformed by a five-year moving average that smooths out short-term variations.

We are not satisfied with this measure of nineteenth century investment globalization for several reasons. First, the United Kingdom was perhaps the most important investing country, but rather important foreign investments were also flowing from France, Belgium, Germany, and after 1900 from the United States. The other big problem is that these yearly export flows do not provide good estimates of the total value of foreign-held assets in the countries to which they are flowing. The way to estimate the total value of capital is to sum current investments over a period of years depreciating the earlier years with an amortization schedule. This is our next step for the British flow figures, and these will need to be weighted by estimates of world GDP. To accomplish this latter we will need to transform Maddison’s (1995, 2001) estimates from 1998 Geary-Khamis U.S. dollars into current British pounds for the nineteenth century (or transform current pounds into 1998 Geary-Khamis U.S. dollars). This will provide a better estimate of nineteenth century investment globalization that the flows numbers shown in Figure 8.

Appendix B: List of Core and Non-core Countries Studied

with IMF Balance of Payments Data.