Beyond the Long Twentieth

Century:

China

in Sub-Saharan Africa and the

Changing Dynamics of the

World-System

Marilyn Grell-Brisk

Institute for Research on World-Systems

University of California, Riverside, Riverside, CA. 92521

v. 2-24-16, 9103 words

This is IROWS Working Paper #106 at https://irows.ucr.edu/papers/irows106/irows106.htm

Abstract

The

growing influence and role of the People’s Republic of China (PRC or China) in

the modern world-economy is the basis of ongoing polemics in world-systems

analysis and in other academic and non-academic fields of study. Twenty years

ago, in The Long Twentieth Century,

Giovanni Arrighi (1994) astutely theorized that the

bifurcation of financial and military power that occurred during the financial

expansion of the late twentieth century was not only anomalous of all other

such expansions but it paved the way for a possible Sino-centered world-system.

In, Adam Smith In Beijing, he went a step further and outlined the rise

of China in light of the United States’ waning hegemonic rule (2007). While the

growing Chinese economy and a complementary expanding role in the global

economy, propelled Arrighi’s to contemplate a

systemic shake-up, he saw the catalyst for the subversion of the modern

world-system ostensibly as China’s demographic size (Arrighi

2007; 1994, p. 371-386). It is true that population size has been shown to have

impacts on economic growth and development. However, this paper asserts that

China has the potential to transform

the logic of the modern capitalist world-system not only because of its

demography but also its distinctive approach to its involvement in the

world-economy, particularly its interactions with those countries of the Global

South.

To

illustrate this point, we examine China’s engagement with Sub-Saharan Africa (SSA)

where it has spent billions of dollars on foreign direct investment and foreign

aid along with a growing trade relationship. I will demonstrate that demographic size alone cannot account for any substantive reorganization of the world-system; that China has taken specific actions, primarily

economic on the surface but with

political underpinnings that could potentially create rippling system-wide change. In providing

considerable economic aid to SSA with the only caveat being the adoption of a 'One China' policy, the PRC is influencing an entire continent’s economic outlook. So

far, initial empirical evidence shows positive growth patterns instead of

further peripheralization in the SSA countries where

China is heavily involved. In addition to

their economic outlook, China is impacting the foreign policy of a bloc of nations

that make up the second most populous

continent in the world, while

simultaneously undermining Western neoclassical ideas of development. Yet, despite

all of this, China appears to maintain and buttress the existing core-periphery

hierarchy and power structures of the world-system. Is this the case that

‘the more things change, the more they remain the same?’

Keywords:

China

in Africa, South-South relations, Sub-Saharan Africa, Development, Geopolitics

The

interplay between China’s demography and expanding economy can clearly bring

about changes in the world economy. This has been shown empirically (Hung,

2015). This paper contends that while China is gaining grounds in the world

economy, it is assisting other countries in the Global South in a way that the

West and those in the developed world had not done before. In the most recent

iteration of a world hegemon as understood by Immanuel Wallerstein, the United

States’ foreign relations including foreign aid, had an implicit ideological

component (a thrust toward democratization of governments and free market

economies) and more recently, with the aid of Bretton Woods institutions, an

explicit economic component (as epitomized by the structural adjustment

programs (SAPS) of the 1990s and the Millennial Development Goals (MDGs) of the

2000s). China’s development projects in the Global South post-reintegration

into the world economy have certainly not insisted on these

ideological-economic terms and China has made a point of not interfering with

the day to day governing practices of the governments in Global South with the

exception of the renunciation of the Republic of China, Taiwan as the sole representative

of China on the global stage. In so doing, China impacts the position of

varying countries in the Global South in the world economic structure. To see

how this plays out, we will now look at the specific case of China’s

involvement in Sub-Saharan Africa.

Brief

Modern History of China in Africa

The

legacy of Chinese involvement in Africa can be traced back to the Bandung

Conference of 1955. The conference goal was to promote Asian-African economic and

cultural cooperation, to oppose colonialism in all its manifestations, and to

promote world peace. China played a central role in the conference using it as

a platform to strengthen its ties with other Asian and African countries. This

was approximately the same time when the Sino-Soviet relationship was becoming

strained and a tangible rift between the two was becoming more and more

evident.[1]

China sought to present itself as the archetypal communist country and distance

itself from the Soviet Union under Nikita Khrushchev. Therefore, it was seeking

to garner influence within the Third World and Africa in particular.

Robert

Scalapino, writing for Foreign Affairs in 1964 saw China’s involvement in Africa as a

direct challenge to Soviet influence on the African continent. He notes,

“Soviet leaders are thus well aware of the fact that the outcome of this

struggle could be crucial to the ultimate balance of power both in the world

and in the Communist camp. They also know that this struggle cannot be won by

military means”[2]

(Scalapino 1964, p. 640). Despite

the fact that Russia had significantly more money and a stronger military

presence in the world than China; the Chinese believed that there were other

approaches to fostering strong lasting relationships with the developing world,

and Africa in particular.

Therefore,

in late 1963, Chinese Premier Zhou Enlai attempted to

further cement Sino-African relations through a ten-country tour.[3]

His stated aims included supporting African and Arab struggle against

imperialism and colonialism in all their forms; their pursuit of neutrality and

non-alignment; their desire for unity and solidarity; their efforts to pursue

dispute settlements by peaceful means; and held that their sovereignty should

be respected by all. Furthermore, he wanted the African and Arab Countries to

know that China was committed to their independence; to their struggle against

backwardness and for economic development; that China would provide aid

projects that yielded quicker results; and that China would not attach

conditions to aid packages nor ask for privileges in return (Enlai 1963).

During

this period in Sino-African relations, China’s support and commitment to the

African liberation movement was epitomized by the Tanzam

Railway Project, which linked Tanzania and Zambia. Several assessments for

building the rail line had been performed between 1963 and 1966 and requests

for financing were solicited from but ultimately unapproved by Britain, the

Soviet Union, the United States, the World Bank, Canada, West Germany, and even

the African Development Bank. The Zambian and Tanzanian governments turned to

China and after much discussion, China stepped up to the challenge. The Tanzam project, which began in 1970 and ended in 1975,

created one single track for 1160 miles from Kapiri Mposhi in Zambia central province, to the port of Dar es Salaam in Tanzania. Being a landlocked country, it

allowed Zambia to free itself from economic dependence on Zimbabwe (then

Rhodesia) and South Africa, both of which were ruled by white governments.

China’s

acknowledgement, response and assistance to the African and Arab struggles paid

off, with some of those countries acknowledging the government of the People’s

Republic of China as early as 1963. More importantly, the African continent

played a pivotal role in the PRC’s 1971 bid for a United Nations seat. The

Republic of China (ROC) – Taiwan – held a seat in the United Nations and on the

UN Security Council as the representative of China. However, in 1971, the

People’s Republic of China placed a bid for this seat. The UN election resulted

in 76 votes in favor of the PRC taking over the ROC seat, 35 opposed and 17

abstentions. Of those 76 positive votes, 26 came from African countries – a

total of 1/3 of the yes votes. Jinyuan Gao puts this

in perspective: “it goes without saying that they made the greatest

contribution to the recovery of China’s legitimate seat in the United Nations”

(Gao 1984, 250).

In the

Post-Mao period, withdrawing from international politics, China began a period

of self-examination and reflection, focusing on internal and domestic policies.

The Tiananmen Square Student Massacre occurs during this time in June 1989. In

1992, you have Deng Xiaoping beginning his economic reforms.[4]

These reforms are significant and helped usher in a new era of Chinese economic

advancement. Given its position on the UN Security Council, China always saw

itself as part of the developing world but also as its de facto leader. As

though presciently, in 1998, Ian Taylor writes, “this position enables Beijing

to project China onto the global stage as a major player in its own right. But,

if this image is to be sustained and carried off, Beijing feels compelled to

maintain an active and visible interest in areas such as Africa which act as a

support constituency to add political and numerical back-up to China’s claims”

(Taylor 1998, 458). In 2000, the first Forum on China-Africa Cooperation was held

in Beijing.

Re-emergence

of China-Africa Relations

During

this first Forum, a Programme for China-Africa

Cooperation in Economic and Social Development was approved and was grounded on

the principles of equality and mutual benefit, diversity, practical results,

common progress, and amicable settlement of differences. This seemed to mirror

the objectives put forth by Enlai during his 1963

trip through Africa. Some of the same ideas reappeared - non-interference in

African countries’ domestic issues, economic aid without strings attached, and

settlement of disputes through peaceful negotiation. An essential change though, and an important

aspect of the Programme was the ‘One-China Policy,’[5]

which the Chinese government believe to be the political foundation for the

establishment of the China-Africa relations.

The

One-China Policy has been a staple of Chinese foreign policy with political,

and strategic implications for China. For its domestic policy, the continued

attempts at isolating the Republic of China (Taiwan) from the rest of the world

makes for political gains within the ruling China Communist Party. The

successful integration of Taiwan into the PRC would be a massive political

payload for any party leader. Militarily and from a maritime geostrategic point

of view, the payoff is just as huge. Taiwan is in the center of the East China

Sea, the Luzon Strait and the Philippine Sea. See Figure 2. It locks China in

through what is commonly referred to as the “first island chain.”[6]

Per The Science of Military Strategy,

“if Taiwan should be alienated from the mainland, China will forever be locked

to the west side of the first chain of islands in the West Pacific, and… the

essential strategic space for China’s rejuvenation will be lost” (Guangqian and Youzhi 2005).

![]()

On the

other hand, for the African countries, the ramifications are different depending

on how they choose to look at this policy. It could be the means to an end (end

being economic growth); it could be a bargaining chip for improving the number

of options for foreign trade relations (India and Brazil are also investing,

although not as heavily as China, in the African continent), for foreign aid,

and for foreign direct investment. It could also mean that China would begin to

drive the formulation of the foreign policy of the countries on the African

continent with diplomatic, trade, and economic implications.

There

is a general agreement that Chinese foreign aid and foreign direct investment

to Sub-Saharan Africa keep increasing. However, the absolute figures vary

wildly in the literature. The need for a high-quality, and systematic record of

China’s aid and foreign investments efforts was made clear at the recent Researching China’s Overseas Finance and

Aid: What, Why, How, Where and How Much? held at the Hopkins School of

Advanced International Studies. As a non-Development Assistant Committee (DAC)

member country, China does not have to follow global development reporting

standards. Therefore, much of the aid packages remain underreported in the

World Bank and United Nations Conference on Trade and Development (UNCTAD)

figures.

Accompanying

this are claims of inadequate transparency in aid packages given to SSA

countries by China. China AidData – a large project,

at William and Mary College – has undertaken the daunting task of tracking

Chinese foreign aid and development projects around the globe with some

success. It was originally created to track under-reported financial flows

(TUFF) at which time a methodology was developed – media based data collection

(MBDC). AidData claims that it is a systematic,

transparent, and replicable approach to gathering development finance data (AidData 2013).

Still,

AidData has been criticized for overestimating the

total aid amounts and for its very methodology.[7] AidData has since attempted to address the issues of data

reliability especially because of its MBDC methods. AidData

now relies heavily on academic case studies and research, and has engaged in

ground-truthing – verifying and updating existing

data with in-person interviews on Chinese development finance and site visits (Muchapondwar et al. 2014).

While

the issue of tracking China’s investment and aid to SSA can be problematic,

there is still the issue of effectiveness. Is FDI and foreign aid benefiting

these African countries and if so how? The existing literature is rich with

theoretical debates as to the impact of FDI and foreign aid on the host

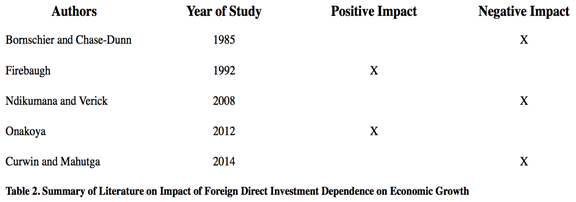

countries (see Table 2 for a summary of the literature). For some, foreign

investment could destroy up-and-coming, new and even established local

businesses. An early study by Volker and Chase-Dunn suggested that FDI and

domestic investment generally promoted economic growth in the short run and was

a strong alternative to privatization as part of structural adjustment

requirements. However, they found that continued dependence on flows of foreign

investments over a long-term period was destructive to economic growth and was

associated with greater income inequality (Bornschier

and Chase-Dunn 1985). It was later shown that not only was FDI beneficial for

the host country but also a catalyst for economic growth (Firebaugh 1992; Onakoya 2012). For Firebaugh, the previous analyses simply

misinterpreted their findings (Firebaugh 1992).

Yet,

doubt associated with the positive link between FDI and economic growth seems

to persist (Curwin and Mahutga

2014; Ndikumana and Verick

2008). Using post-socialist countries (given their quick transition into

industrialized economies without FDI) to test this link, Curwin

and Mahutga found that FDI penetration reduced

economic growth both in the long and short term. That domestic investment was a

much more statistically significant correlate to economic growth is supported

both empirically and in theory (Curwin and Mahutga 2014). One

of the most interesting papers in the literature discussing the impact of

foreign investments, especially in the developing world, is by Jeffrey Kentor and Terry Boswell.

In Foreign Capital Dependence and Development:

A New Direction, the authors find that foreign investment concentration

does have a significant negative effect on economic growth but that is

primarily due to the structure of the investment concentration. That is, the

negative effect is completely dependent on whether there are numerous trade and

investment partners or a single one. If the foreign investment is concentrated

through one trade partner, the effects are extremely negative. The authors

claim that this “inhibits an LDC’s ability to construct and implement economic

policies that are in its own long-term interest. A lack of autonomy affects the

bargaining power of states in dealing with the transnational corporations they

host and in negotiating with foreign investors in global markets…” (Kentor and Boswell 2003, p. 310). However, with multiple

partners the negative effects diminish. Under the Kentor

and Boswell model, in the case of SSA, FDI would not be intrinsically bad. As

these countries continue to grow economically, expanding FDI partnerships with

other emerging economies like India and Brazil would the most beneficial in the

long run.

The

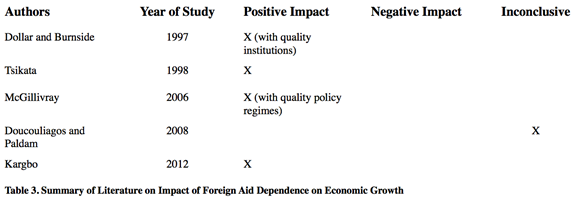

effect of foreign aid on the economy of developing nations is also a source of

major debate (See Table 2). Early studies showed that aid worked to the extent

that without it, economic growth would be much lower (Tsikata

1998). In their influential 1997 paper, on the impacts of foreign aid on

developing countries, Dollar and Burnside demonstrated that aid mostly grew the

recipient country’s economy but that for aid to remain effective, good quality

state institutions were of utmost necessity (Dollar and Burnside 1997).

McGillivray found similar results as Dollar and Burnside but also added to the

discourse by asserting that good policy regimes were needed for foreign aid to

have a positive impact on economic growth (McGillivray 2006).

On the

other hand, Doucouliagos and Paldam’s

2008 meta-analysis had inconclusive results when looking at aid effectiveness

on the economy (Doucouliagos and Paldam

2008). Still, the most recent empirical

study, while specific to the politically unstable and aid-dependent Sierra

Leone, demonstrated that over time, aid had a strong impact on economic growth

(Kargbo 2012).

In SSA, China has infused the economies with a large amount of foreign

aid and at the same time injected high amounts of FDI into the economy. As this

unfolds there has been significant impacts on infrastructure, exports and

general economic expansion (Kaplinsky and Morris

2009; Kpetigo and Tapsoba

2011; Ndambendia and Njoupouognigni

2010).

Chinese

Foreign Aid and Investment in SSA

As

part of this new cooperative development program, during the 2000 Forum, China

announced the cancellation of 1.2 Billion USD worth of debt from a total of 31

African countries and by 2005, tariff exemptions were applied to 400 items for

29 Sub-Saharan countries. In 2004, 9400 African were trained in China through

its African Human Resource Development Fund. In 2005, 15,600 scholarships were

distributed to 52 different countries. Since 2000 thousands of Chinese doctors

and teachers are working in SSA through development aid projects. At the most

recent Forum, China announced that it was issuing a 20 Billion USD line of

credit to Africa. Again, due to the lack

of transparency, these figures are thought to be underestimates.

One

thing is indisputably clear – China’s economic relations with SSA have

increased significantly since 2000. According to IMF DOT statistics, the

portion of China’s SSA imports increased from 3% in 2001 to 11% as of 2012. For

the same period, SSA’s imports from China increased from 15% to 20% as opposed

to decreasing imports from DAC members from 75% to 35%. Even though the

absolute percentage change in SSA’s imports from China is only a 5% increase,

the drop in imports from DAC members is 35%. There may be a number of reasons

for the drop in imports from DAC members but with SSA’s increasing trade with

China and other developing countries, this speaks volumes.

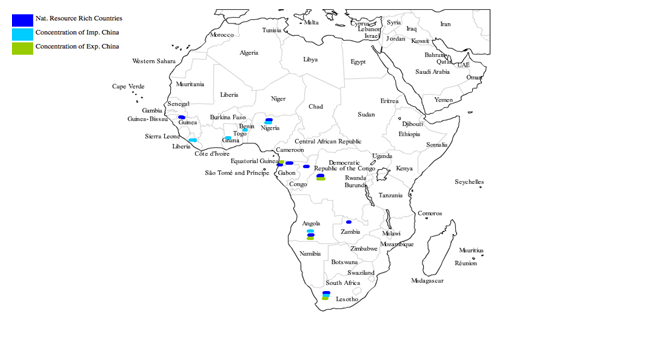

Furthermore,

the nature of the trade relations between SSA and China is striking as shown in

Figure 3. Trade relations between SSA and China is concentrated in Nigeria,

South Africa, Liberia, Ghana, Benin, and Angola accounting for more than 80% of

total imports from China. Angola,

South Africa, Dem. Rep. of Congo, and Equatorial Guinea account for

approximately 75% exports to China. Kaplinsky, McCormick and Morris have written extensively on

why this particular group of countries (Kaplinsky,

McCormick and Morris 2010). So have Brautigam and

Kobayashi (Brautigam, 2011, 2010, 2008; Kobayashi

2008).

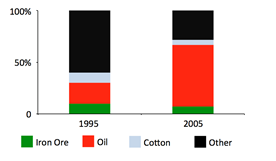

What all the authors seem to point to though, is the fact

that much of SSA’s exports to China involve the natural resource sector. See

Figure 4 and 5. UNCTAD and the Ministry of Commerce the People’s Republic of

China (MOFCOM) data show FDI to Africa growing faster than any other country’s

between 2004 and 2007 – 1 Billion USD to 4.5 Billion USD. Per Kaplinsky and Morris, Chinese FDI in SSA, this rapid

increase in FDI is used primarily to support resource-extraction projects in

SSA (Kaplinsky and Morris 2009). Brautigam implies

that China’s venture into SSA has to do with China’s own self-awareness of its

growing need for natural resources, writing that the Chinese “were well aware

that resource scarcities, particularly in domestic energy, would soon become an

issue for domestic production, and they moved to position the country to

overcome that challenge” (Brautigam 2008, p.

11). This follows the same logic of Kaplinsky and Morris who noted that the increasing price of

commodities starting in 2001 led to increased demand for energy, minerals, and

food crops for China and India but also for other developing countries. This

precipitated the need to tap into underdeveloped natural resources and markets

on the African continent.

What all the authors seem to point to though, is the fact

that much of SSA’s exports to China involve the natural resource sector. See

Figure 4 and 5. UNCTAD and the Ministry of Commerce the People’s Republic of

China (MOFCOM) data show FDI to Africa growing faster than any other country’s

between 2004 and 2007 – 1 Billion USD to 4.5 Billion USD. Per Kaplinsky and Morris, Chinese FDI in SSA, this rapid

increase in FDI is used primarily to support resource-extraction projects in

SSA (Kaplinsky and Morris 2009). Brautigam implies

that China’s venture into SSA has to do with China’s own self-awareness of its

growing need for natural resources, writing that the Chinese “were well aware

that resource scarcities, particularly in domestic energy, would soon become an

issue for domestic production, and they moved to position the country to

overcome that challenge” (Brautigam 2008, p.

11). This follows the same logic of Kaplinsky and Morris who noted that the increasing price of

commodities starting in 2001 led to increased demand for energy, minerals, and

food crops for China and India but also for other developing countries. This

precipitated the need to tap into underdeveloped natural resources and markets

on the African continent.

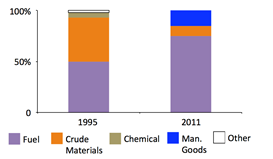

In

2006, Ron Sandrey documented the structure of China’s

import from Africa in 1995 as follows: 20% - oil, 10% - iron ore, and 10% -

cotton. However, by 2005, 60% - oil, 7% - ore, 5% - cotton (Sandrey

2006). A different and more recent

report shows that not much has changed in the structure of Chinese import from

Africa. UN Comtrade Statistics show that in 1995

China’s import from SSA was 50% fuel, 43% crude material, 5% chemicals. By 2011,

the figures had changed dramatically to 75% fuel, 15% crude material, and 15%

manufactured goods (excluding South Africa).

![]()

![]()

MOFCOM’s

Statistical Bulletin of Outward FDI document Chinese FDI to SSA increase

substantively between 2003 and 2010, peaking in 2008. This also confirms that

most of the FDI is to resource-rich SSA countries and most likely in support of

aid-based development and infrastructure projects or resource financed

infrastructure (RFI).

In a

recent paper, AidData indicated that the correlation

between official development assistant (ODA-type) aid provided by the Chinese

are not necessarily linked to natural resource extraction as previously

highlighted by other scholars and that Chinese aid was as policy-driven as aid

provided by DAC members (Muchapondwar et al.

2014). While this might be the case, the

fact remains that Chinese “aid” is a combination of ODA-type aid and other

official flows (OOF-type) aid but majority of this “aid” is made up of

OOF-type. So, the fact that Chinese ODA-type aid cannot be linked strongly to

their investments in the natural resource extraction sector does not mean much

if most of its aid is OOF-type.

The

case of the Angola is particularly insightful to our understanding of the links

between Chinese aid programs and FDI. In 2002 when Angola was at the height of

its economic and international disfavor – denounced for its domestic political

and social policies; suffering from inability to gain credit through the BWIs;

and a rejected attempt to gain access to funds by way of Japan and South Korea

– China stepped in and extended massive credit lines to Angola. The Chinese

government through the China Construction Bank (CCB) and Export Import Bank of

China (Exim-Bank) extended a 150 Billion USD loan to Angola for infrastructure

projects. The interest rate on the loan was extremely low and the loan was

guaranteed by Angola agreeing to provide China with 10,000 barrels of oil per

day. However, the Chinese government did not allow direct fund transfers to the

Angolan government. Instead, the money was given directly to those companies

that were to perform the infrastructure projects and while 30% of these

companies were supposed to be Angolan, the remaining companies were all Chinese

state owned enterprises (SOEs). This has led some to claim that China’s venture

into Africa and other countries of the Global South can be explained through

the theory of elite capture. It is essentially a means of distributing

government resources to members of the elite, which government officials

themselves belong to. Funds are transferred from the government to

pseudo-private state-owned enterprises that then gain access to funds and

resources even outside of China where certain rules and obligations may not apply.

SSA

economies have unmistakably experienced an upsurge since China’s

‘intervention’. According to the World Bank, at present, economic activity

continues to be robust in SSA. From 1995 to 2013, the region enjoyed an average

GDP growth rate of 4.5% (compounded weighted average of ‘developing SSA’[8]).

Average un-weighted growth rates across all SSA countries for the period is

2.4% translating into an increase of about 30% GDP per capita on average.

According to Drummond and Liu, China’s economic growth (which has been

remarkable) resulted in an increase in investment and aid to SSA and direct

trade expansion for its African partners. More dramatically they found that for

resource-rich SSA countries, one percentage point increase in China’s domestic

investment growth is accompanied by a 0.8% increase in export growth rate

(Drummond and Liu 2013).

Rosen

et al at the US Department of Agriculture Economic Research Service, documented

that between 1980 and 2000, grain production in Africa, an indicator of food production,

was consistent with the rate of population growth. However, between 2000 and

2010, grain production growth accelerated to 4.1% per year, which translates to

1.6% annual growth rate per capita. They note that this represents significant

improvements over the two prior decades (Rosen et. al. 2012). In 2013, Vanessa Jacquelain an economist at the Agence

Française de Dévelopment

noted that SSA countries “now carry the lowest external debt burden in thirty

years” (Jacquelain 2013). The World Bank Data also show improvements in

the areas of health and education. Life expectancy in SSA cratered in the 1980s

at approximately 48.5 years and only started increasing around 2003. The

average life expectancy in SSA is now at 56.4 years. Primary school completion,

like life expectancy was consistently low since the 1980s and only started

increasing around 2001. It is highly probable that the cratering of world

development indicators in SSA like GDP growth, life expectancy and education

are correlated to the rise of neoliberalism and in particular, it’s instrument

- foreign aid driven by policy and adjustment strategies epitomized in the

Poverty Reduction Strategy Papers and the Millennium Development Goals. China’s

venture in SSA can be understood as presenting a superior alternative to

SAP-driven economic aid and FDI.

Neoliberalism’s

Impact on SSA

Writing

for the re-launch of the New Left Review,

Perry Anderson claimed that the principle aspect of the past decade was the

“virtually uncontested consolidation, and universal diffusion, of

neo-liberalism” (Anderson 2000, p. 6).

The rise of the neoliberal agenda in the developed world was applied

without thought to the African continent beginning in the late 1970s and early

1980s. The World Bank’s 1981 Accelerated

Development in Sub-Saharan Africa: An Agenda for Action, commonly called The Berg Report, exemplified this. The

market being the driver of all socio-economic growth, and the only way to

reduce poverty meant that African economic, political and social institutions

were to be restructured so as to make the private sector front and center. This neoliberal project in Africa was

supposed to be inclusive and open Africa to the global economy; encouraging

growth by relying on agriculture and allowing complete control by market

mechanisms.

Yet,

in 1992, Paul Lubeck claimed that after “nearly a decade of submission to

structural adjustment programs (SAPs) administered by the World Bank and the

International Monetary Fund (IMF), neither the promised “accelerated growth,”

nor market equilibrium, nor new foreign investment has been forthcoming”

(Lubeck 1992, p. 520). Per Lubeck, there

was some consensus amongst most scholars on the root causes of the African

non-development situation. These included random boundary drawing among the

colonial powers plus their patterns of export, harmful ecologically practices

that degraded the environment, along with the Third World debt crisis of the

1980s. However, neoliberal policies were the hammer that drove the nail into

the coffin. Hellinger et al.

acknowledged at the United Nations Civil-Society Hearings on Financing for

Development that global economic management dominated by the G7 finance

ministries in the form of structural adjustment programs engendered the

destruction of local businesses and farms, the reduction of employment and

incomes, and the increase in poverty and economic inequality. In short,

wherever its implementation was attempted, it produced general social, economic

and financial instability (Hellinger et al. 2001).

Padraig

Carmody in his book, Neoliberalism, Civil Society and Security raises interesting

questions about the contradictions inherent in neoliberalism as a policy in

Africa. He argues that the failure of market liberalization and structural

adjustment programs to grow the economies of African countries was met with

further requests for adjustment. The model for development itself was never

questioned. In the case of Zimbabwe, he notes that changes brought about by

neoliberal pressure on the Mugabe government only served to increase the

precariousness of the people of Zimbabwe (Carmody

2007). George Caffentzis questions the fervent

continuation of SAPs writing, “if African economies performed so poorly… then

one can only declare that its ruling economic policy is to blame, especially

when this policy was to get its legitimacy from its claim to reduce debt,

increase FDI and export shares” (Caffentzis 2002, p.

93).

Adesina, went

further than most in completely condemning neoliberalism as an intellectual

thought and tradition (Adesina 2004). He brought into

question the tenets of neoliberalism – the belief in the moral necessity of

market forces in the economy and entrepreneurs as a good and necessary social

group. For Adesina, neoliberalism relied on a ‘verbal

logic’ instead of complex mathematical modeling, in order to ensure its

accessibility and appeal to the masses. Furthermore, the advanced economies of

the world championed trade and market liberalization, requiring SSA to open its

markets, with sickening results. Adesina notes that,

“the elimination of the agricultural protection in the OECD countries would

have meant an estimated gain for the SSA economies of US$6 per capita or

US$3,857.4 million…” (Adesina 2004, p. 12).

The

impact of neoliberal mechanisms like SAPs and the opening of SSA markets

manifested themselves in the contraction of the economy and the mounting of

social development crisis. It also led to the incapacity of states to respond

to increasing global and financial crises. UNCTAD statistics from 2002 show

persistently declining terms of trade for SSA beginning around 1980 through

1998. Conditions imposed by World Bank and IMF during this period eroded

special differential treatments that some African countries had enjoyed previously.

Even more crushing is the fact that countries that were strong implementers of

the SAPs experienced negative annual GDP growth compared to “weak adjusting” or

“non-adjusting” who were either experiencing little, but positive growth rates.

New Structures and Change?

So we

come back to the question of how China is changing the world-economic system

especially in terms of how it is stratified; and how China’s rise is going to

affect SSA’s own station in the world-system and world-economy. In this

section, I look at systemic change from a more conceptual basis rather from a

micro-macro economic sense.

Creating

hegemony and geopolitics

In

this effort, we begin by examining the concept of hegemony as a process of

struggling for influence; perhaps in the pursuit of a version or new

idea/concept of “development” that may or may not conform to Western standards.

Maybe, then we can begin to understand the notion of hegemony as non-static and

specific to a particular vision of domination.

The idea of hegemony is complicated. In terms

of global influence, is it mostly economic? Is it mostly political? Is it

mostly military? Is it ideological? The $682 billion spent by the U.S. in 2012,

according to the Office of Management and Budget, was more than the combined

military spending of China, Russia, the United Kingdom, Japan, France, Saudi

Arabia, India, Germany, Italy and Brazil — which spent $652 billion, according

to the SIPRI Military Expenditure Database. Still, the US has yet to decisively

win a military intervention since the end of WWII not counting Grenada. And

while some talk of China’s economic rise, that is tied to and dependent on the

US’s economy for good or bad.

In

classic trimodal world-system analysis, a “core”

country exhibiting dominance over all others in areas of production, trade and

finance would be considered hegemonic. However, to understand the current

dynamics of global interaction amongst nations, it makes more sense to

understand the world-system, more as a fluid enough superstructure where

nations can create hegemony. By taking this approach that we can have a better

understanding of what China is doing in the Global South and in our case, SSA.

If China is engaging in ‘hegemony-making’, its economic assistance to SSA can

be seen as powerfully subversive and potentially destabilizing to the world

system, especially given its political implications. Conceptually, we can refer

to Gramsci’s apropos idea of hegemony that comes across not as static but

dynamic.

Hegemony

in Gramscian terms is more of a process – a wrangling

of sorts for influence but done in a

shrewd, restrained way. This type of hegemony largely suggests a dominant or

subordinate group leading through persuasion, with a hint of coercion. It is

not categorically embodied by one country with predetermined attributes. It is

achieved through exercising power over subordinate groups, but even with power

firmly in its grasp, leadership is equally important (Gramsci 1971).

Furthermore, gaining hegemony does not involve the total domination of all

competing potential replacements of the failing hegemon but rather, it is

aligning one’s interests (economic, political, social) with that of everyone

else. The consent of different

subordinate groups that allow themselves to be lead

by a dominant group is absolutely necessary. John Storey

explains that hegemony implies “a society in which there is a high degree of

consensus… in which subordinate classes appear to actively support and

subscribe to values… which bind them to, incorporate them into, the prevailing

power structure” (Storey 1993, p. 119). In a way,

this is similar to the idea of comparatively complementary regimes of

accumulation put forth by Astra Bonini. In the paper Complementary and Competitive Regimes of

Accumulation, she demonstrates that if the hegemonic regime of

accumulation, structures the economy in a way that is comparatively competitive

to raw-material producing countries, then those countries will be able to

effect upward economic mobility within the modern world system (Bonini 2012).

At the

first FOCAC, President Jiang Zemin reminded conference attendees that while

China was the largest development country, Africa was the continent with the largest number of developing countries. He

announced that the “Chinese

people and the African people both treasure independence, love peace and long

for development and that they are both important forces for world peace and

common development. It is the unremitting efforts made by the people throughout

the world including, the Chinese and African peoples, that forces for world

peace have kept growing and the world development cause has made considerable

progress” (Zemin 2000). He

went on to further state that the root cause of unequal development that marks

today’s world is due to

“many irrational and inequitable factors in the current international political

and economic order… [that] are detrimental not only to world peace and

development, but also to the stability and development of the vast number of

developing countries” (Zemin 2000).

President Jiang

Zemin then outlined the Five

Principles of Peaceful Coexistence, characterizing a more positive approach to

world cooperation and existence. Leaving aside any debate about the

effectiveness of China’s foreign direct investment and foreign aid to Africa,

it appears that China has made serious headway in terms of the acceptance of

its view on development and coexistence in much of the Global South.

Gramsci writes, “undoubtedly the fact

of hegemony presupposes that account be taken of the interests and the

tendencies of the groups over which hegemony is to be exercised, and that a

certain compromise equilibrium should be formed -- in other words, that the

leading group should make sacrifices of an economic-corporate kind. But there

is also no doubt that such sacrifices and such a compromise cannot touch the

essential; for though hegemony is ethical-political, it must also be economic,

must necessarily be based on the decisive function exercised by the leading

group in the decisive nucleus of economic activity” (Gramsci 1934, p. 161).

That is to say, the period during which there is a struggle for hegemony,

compromises and alliances will be made with subordinate groups to bring them

all together under a hegemonic umbrella.

Writing for the Financial Times in 2008, President of Sengal,

Abdoulaye Wade explains, “China’s approach to our needs is simply

better adapted than the slow and sometimes patronising

post-colonial approach of European investors… [That] economic relations are

based more on mutual need… [and that] China, which has fought its own battles

to modernise, has a much greater sense of the

personal urgency of development in Africa than many western nations” (Wade

2008). In 2009, Paul Kagame,

President of Rwanda, openly praised the Chinese form of business making and

investments in Africa (BBC News October 11, 2009). And in 2010, The Globe and Mail noted that South Africa’s President Jacob Zuma,

praised China as the example of economic policy success (Geoffrey August 25,

2010).

From a Gramscian

perspective, we can understand China as playing a type of ‘war of position’,

which is not so much about a cultural struggle in as much as it is a

politico-economic one. China provides an alternative mode of development for

SSA – one in which it refrains from interfering with the countries’ domestic

politics vis-à-vis its political and economic institutions and bureaucracy. It

is also setting an example for other South-South relations (India and Brazil’s

FDI and aid to SSA). This ‘war of position,’ is a long struggle that becomes

increasingly important during times of organic crisis. Post

2008, as the global recession became more intense, China had to be more willing

to play a larger role in the world-economy and in the less developed world. The

fact remains that China’s own upward mobility within the world system is

improved through its facilitation with the upward mobility of so-called

peripheral countries. Further, a Sino-centric world economic system is only

possible to the extent that China succeeds in creating a system of alliances,

which allows it to mobilize the majority, to its goals. This could produce what

Arrighi and Silver understood as a non-catastrophic

transition into a new world order (Arrighi and Silver

1999). In Chaos and Governance, the

authors note, “US adjustment and accommodation to the rising economic power is

an essential condition for non-catastrophic transition… An important aspect of

this is the capacity and willingness of the East Asian economic expansion to

open up a new path of development for themselves and for the world that departs

radically from the one that is now at a dead-end” (Arrighi

and Silver 1999, 289).

Geopolitics

China

continues to claim and demonstrate that it has a method of development that is

non-intrusive yet effective. Many world leaders both in the Global North and

South are beginning to buy into that rhetoric (most likely for their own

reasons and for their own perceived advantage). March 28, 2014 was a big day

for the legitimization of China’s policies in the world economy. The United

Kingdom, going against the United States’ advice, officially voted to join the

Chinese-created and Chinese-led Asian Investment Infrastructure Bank. The

response to the AIIB has been incredibly polarizing with some seeing it as an

aggressive blow at the US’s hegemonic position in the world as the Chinese

alternative to the World Bank while others see it more as a way to balance the

scales in favor of the weaker and emerging economies. Hung writes, “China, in other

words, is deliberately forgoing some of its leverage, including in the very

organization it is setting up. And it is doing so because it wants the cover

and the legitimacy that will come from the participation of other countries.

Creating the A.I.I.B. is not Beijing’s attempt at world domination; it is a

self-imposed constraint, and a retreat from more than a decade of aggressive

bilateral initiatives” (Hung 2015b).

So if

China is in fact playing a long ‘war of position,’ how is this playing out in

terms of its position in the stratified world system? First we turn to a

seminal piece of work – The

Stratification of the World-Economy: An exploration of the Semiperipheral

Zone. In it, using the population by state (as a percentage of total population)

and the log of Gross National Product (GNP) per capita in 1970 USD, the authors

empirically demonstrate the long-term stability of the trimodal

structure of the world economy over a 45-year time period. In this paper, Arrighi and Drangel confirmed that

a trimodal world system was fully in place and that trimodality had persisted over time. Based on their data,

movement between the three zones were extremely limited and noted, “95% of the

states which we could find data (and 94% of total population) were in 1975/83

still on or within the boundaries of the zone in which they were in 1938/50” (Arrighi and Drangel 1986,

44). If we were to take the period, 2000

to 2010 and using the Arrighi Drangel

method, we notice significant changes happening in the structure of the world

economy especially in 2010 when the economies of both China and India are

growing and causing major shifts in the stratification process. The lines

between the semi-periphery and periphery become blurred and there is almost a

quad-modal distribution. However, what is not clear is whether the changes in

the distribution of the organization of the world economy are permanent or

simply an anomaly. Herein lies the difficulty of understanding global trends –

the need for retrospection. On the

African continent, the economies of the natural resource-rich countries are

clearly expanding in a positive way, but only time can tell how this will

translate in terms of improving the day-to-day lives of the average African.

Further, while we can empirically observe broad changes occurring in these

peripheral states, whether they are permanent or temporary remains to be seen.

For now, there are positive changes occurring that should be documented and

validated instead of being dismissed as yet another attempt of the Rest (in

this case China) imitating the West (their imperialist/colonialist past).

China could be

engaging in hegemony making but most likely what we are seeing is China playing

geopolitics. Its economic reforms have allowed it to compete successfully in

the world economy and it has expanded its trade networks throughout the Global

South. Some scholars such as Hung (2015b) and Karatasli

and Kumral (2015) made arguments to the effect that

China wants and needs to maintain the status quo/the current world economic

structure. Some have branded China’s engagement with SSA as some form of

neocolonialism or neo-imperialism.

However, one must be much more particular when applying these

concepts/terms to describe and define SSA’s relationship with other countries.

On the one hand, you have the Berlin Conference of 1884 where the supposed

world leaders officially agreed on how to separate a continent. A continent

already inhabited. There, you have formal colonial imperialism and

colonization. Not until the 1950s when de-colonization began to occur that you

have entire nations/peoples beginning to grab and demand their sovereignty. Of

course, one can argue that de-colonization occurred primarily because the costs

of colonialization outweighed the benefits to the colonialists. If we begin to

talk about neocolonialism and neoimperialism, China’s

involvement in SSA is qualitatively different.

China is engaging

in geopolitics in a multipolar world. For now, only time will tell the true

impact of China on SS; but so far, so good.

References

Adesina,

Jimi O. 2004. From Development Crisis to Development Tragedy: Africa’s

Encounter with Neoliberalism.

International Development Economics Associates (IDEAS) International

Conference on The Economics of the New Imperialism.

AidData. 2013. A Rejoinder to

Rubbery Numbers on Chinese Aid

http://aiddata.org/blog/a-rejoinder-to-rubbery-numbers-on-chinese-aid

Anderson,

Perry. 2000. Renewals. New Left Review

11, 1:1-20.

Andic,

S, and A. Peacock. 1961. The International Distribution of Income. Journal of the Royal Statistical Society,

ser. A, 124:206-18.

Arrighi,

Giovanni.

--2007. Adam Smith In Beijing: Lineages

of the Twenty-First Century. New York: Verso.

--1994. The Long Twentieth Century:

Money, Power and the Origins of our Times. New

Edition. New York: Verso.

Arrighi,

Giovanni, and Beverly J. Silver. 1999. Chaos and Governance in the Modern World

System. Minneapolis: University of Minneapolis Press.

Arrighi,

Giovanni and Jessica Drangel. 1986. The

Stratification of the World Economy: An exploration of the Semi-peripheral

Zone. Review no. 1 10: 9-74.

BBC News. October 11, 2009. China Praised for African Links.

http://news.bbc.co.uk/2/hi/africa/8301826.stm

Bonini,

Astra. 2012. Complementary And Competitive Regimes of Accumulation: Natural

Resources and Development in the World-System.

American Sociological Association

Journal of World System Research, no. 18. 1: 50-68.

Bornschier,

Volker and Christopher Chase-Dunn. 1985. Transnational

Corporations and Underdevelopment. New York: Praeger.

Bourguignon,

F., and C. Morrison. 2002. Inequality Among World Citizens: 1820-1992. The American Economic Review no. 92,

4:727-744.

Brautigam, Deborah.

--2011.

Aid ‘With Chinese Characteristics’: Chinese Foreign Aid and Development Finance

Meet the OECD-DAC Regime,

Journal

of International Development no. 23, 5: 752-764.

--2010.

The Dragon's Gift: The Real Story of China in Africa, Oxford: Oxford University

Press.

--2008.

China’s African Aid – Transatlantic Challenges. German Marshall Fund of the United States Paper Series. Washington,

DC.

Caffentzis,

George. 2002. Neoliberalism in Africa, Apocalyptic Failures and Business as

Usual Practices. Alternatives:

Turkish

Journal of International Relations 1, 3:89-104, p93.

Cai, Fang. 2010. Demographic Transition,

Demographic Dividend, and Lewis Turning Point in China. Economic Research Journal, 4:4-13.

Cai,

Fang, and Meiyan Wang. 2009. China’s process of

ageing before getting rich in The China

population and labor yearbook, volume 1:

The

approaching Lewis turning point and its policy implications,

eds. Cai Fang and Du Yang, 49-64. Leiden and Boston:

Brill.

Carmody,

Padraig. 2007. Neoliberalism, Civil Society and Security in Africa. Palgrave

MacMillan. New York, New York.

Curwin, K. D., and

M. C. Mahutga. 2014. Foreign Direct Investment and Economic Growth: New

Evidence from Post-Socialist Transition Countries. Social Forces 92, no. 3: 1159–87.

Dollar, David and Craig Burnside. 2000. Aid, Policies,

and Growth. American Economic Review

90, no. 4: 847–68.

Doucouliagos, Hristos,

and Martin Paldam. 2008. Aid effectiveness on growth:

A meta study. European Journal of Political Economy 24, no. 1: 1-24.

Drummond,

Paulo and Estelle Xue Liu. 2013. Africa’s Rising

Exposure to China: How Large Are Spillovers Through Trade?

IMF Working Paper.

WP/13/250.

Enlai, Zhou. 1963. Speech to People’s Congress in Somalia.

http://www.china.org.cn/english/features/China-Africa/82054.htm

http://www.chinadaily.com.cn/china/2010-08/13/content_11149131.htm

Firebaugh, Glenn. 1992.

Growth Effects of Foreign and Domestic Investment. American Journal of

Sociology 98, no.1: 105-130.

Firebaugh, Glenn and Brian Goesling. 2004. Accounting for the Recent Decline in Global

Inequality. American Journal of Sociology

110, no. 2:283-312

Foster,

John Bellamy, Robert McChesney, and R. Jamil Jonna. 2011. The Global Reserve Army of Labor and the New

Imperialism.

Monthly Review – An Independent

Socialist Magazine 63, no. 6:1-31.

Gajwani, Kiran, Ravi Kanbur, and Xiaobo Zhang. 2006. Comparing the Evolution of

Spatial Inequality in China and India: A Fifty-Year

Perspective.

DSGD Discussion Paper. International

Food Policy Research Institute, Washington DC.

Gao,

Jinyuan. 1984. China and Africa: The Development of

Relations over Many Centuries. African

Affairs. 83, no. 331:241-250.

Garnaut, Ross, and Yiping Huang. 2006. Continued Rapid Growth and the Turning

Point in China’s Development in The

Turning Point in

China’s Economic Developments,

eds. Ross Garnaut and Ligang

Song, 12-34. Canberra: The Australian National University E-Press.

Gill,

Indermit Singh, Homi J. Kharas, and Deepak Bhattasali.

2007. An East Asian Renaissance: Ideas for Economic Growth. World Bank Publications.

Gramsci,

Antonio.

--1971.

Selections from the Prison Notebooks. 2010

print. Hoare, Quintin and Georggrey N. Smith,

eds. and trs. 1971. Lawrence and Whisharts: London.

--1934.

Selections From the Prison Notebooks of Antonio Gramsci. Hoare, Quintin and Georggrey N. Smith, eds. and trs.

1971. International Publishers: New York,

NY.

Guangqian, Peng and Yao Youzhi eds. 2005. The Science of Military Strategy. Beijing:

Military Science Publishing House. Requoted from the

Center

for Strategic and Budgetary Assessments article, by Iskander

Rehman Why

Taiwan Matters 2/28/2014.

Hellinger, Douglas et. al. 2001. Stripping Adjustment

Policies of their Poverty-Reducing Clothing: A New Convergence in the Challenge

to

Current Global Economic Management.

http://www.developmentgap.org/uploads/2/1/3/7/21375820/stripping_adjustment_policies.pdf

Huang,

Yiping & Tingsong

Jiang. 2010. What does the Lewis turning point mean for China? A computable

general equilibrium analysis.

China

Economic Journal. Vol. 3, No. 2, pp. 191-207.

Hung,

Ho-Fung.

--2015a.

The China Boom. Forthcoming. Columbia

University Press. New York, New York.

--2015b.

China Steps Back. New York Times: The

Opinion Pages.

Hung,

Ho-Fung and Jaime Kucinska. 2011. Globalization and

Global Inequality: Assessing the Impact of the Rise of China and India, 1980-2005.

American

Journal of Sociology 116. no. 5:1478-1513

Jacquelin,

Vanessa. 2013. Toward a Sustainable External Debt Burden in Sub-Saharan Africa.

Ideas for Development: Blog by the Agence Française de Développement.

http://ideas4development.org/en/toward-a-sustainable-external-debt-burden-in-sub-saharan-africa

Kaplinsky, Raphael, Dorothy

McCormick and Mike Morris. 2010. Impacts and Challenges of a Growing

Relationship Between China and

Sub Saharan Africa. in The Political Economy of Africa. ed. V. Padayachee.

Routeledge: New York.

Kaplinsky, Raphael, and Mike Morris.

2009. Chinese FDI in Sub-Saharan Africa: Engaging with Large Dragons.

European Journal of

Development Research Special Issue 24, no.1:

551-69.

Kargbo, Philip. 2012. Impact of

Foreign Aid on Economic Growth in Sierra Leone: Empirical Analysis. UNU-WIDER Working Paper 2012/07.

Kentor, Jeffrey and Terry

Boswell. 2003. Foreign Capital Dependence and Development: A New Direction. American Sociological Review 68, no.

2:301-313.

Kim,

Ha-Young. 2013. Imperialism and Instability in East Asia Today. International Socialism. Issue 138.

http://isj.org.uk/imperialism-and-instability-in-east-asia-today

Kobayashi,

Takaaki. 2008. Evolution of China’s Aid Policy. JBICI

Working Paper 27, Japan Bank for International Cooperation, Tokyo, Japan.

Korzeniewicz, R.P., and S. Albrecht. 2013. Thinking Globally

about Inequality and Stratification: Wages across the World. 1982-2009.

International Journal of Comparative Sociology 53, no. 5–6: 419–43.

Korzeniewicz, R.P., and T. Moran. 1997. World Economic Trends

in the Distribution of Income, 1965-1992. American

Journal of Sociology 102, no.4: 1000-1039

Kpetigo, Dzifa

K., and Sampawende J-A. Tapsoba.

Chinese Foreign Direct Investments and Sub-Saharan Africa's Exports. African

Economic Conference 2011/

Green

Economy and Structural Transformation. Center

for Studies on Modern and Contemporary China, Paris, France.

Lewis,

Arthur. 1954. Economic Development with Unlimited Supplies of Labour. Manchester

School of Economics and Social Studies 22, no. 2:139-191.

Lindbaek, Jannik.

1997. Emerging Economies: How Long Will the Low-Wage Advantage Last?

http://training.itcilo.it/actrav_cdrom1/english/global/seura/ifcemer.htm

Lubeck, Paul M. 1992. The Crisis of African Development:

Conflicting Interpretations and Resolutions. Annual Review of Sociology, 18:519-540.

McGillivray, Mark

et al. 2006. Controversies over the Impact of Development Aid: It Works;

It Doesn’t; It Can, but That Depends … Journal

of International Development 18, no. 7: 1031–50.

Ministry

of Human Resource and Social Security. 2012 Annual Bulletin.

http://www.gov.cn/gzdt/2013-05/28/content_2412954.htm

Muchapondwar

et al. 2014. ‘Ground-truthing’ Chinese development

finance in Africa: Field evidence from South Africa and Uganda.

WIDER Worker paper

2014/031.

Ndambendia, Houdo,

and Moussa Njoupouognigni. 2010. Foreign Aid, Foreign

Direct Investment and Economic Growth in Sub-Saharan Africa:

Evidence

from Pooled Mean Group Estimator. Canadian

Center of Science and Education 2, no. 3: 39-45

Ndikumana, Léonce,

and Sher Verick. 2008. The linkages between FDI and

domestic investment: Unraveling the developmental impact of foreign investment

in sub-Saharan Africa. Development Policy Review 26, no. 6: 713-726.

Nelson,

Richard. 1956. A Theory of the Low-Level Equilibrium Trap in Underdeveloped

Economies. The American Economic Review

46, no. 5:894-908.

Onakoya, A.B. 2012. Foreign Direct

Investments and Economic Growth in Nigeria: A Disaggregated Sector Analysis. Journal of Economics and Sustainable

Development 3, no. 10: 66-78.

Passé-Smith,

John T. 1993. Could It Be That The Whole World Is Already Rich? A Comparison of

RGDP/pc and GNP/pc Measures. 103-118 in

Development and Underdevelopment: The

Political Economy of Inequality, eds. M.A. Seligson and J.T. Passé-Smith. Lynne Reiner: Boulder,

Colorado

Ram,

Rati. 1989. Level of Development and Income Inequality: An extension of

Kuznets-Hypothesis to the World-Economy. Kylos 42: 73-88.

Rock,

Michael T. 1993. ‘Twenty-Five Years of Economic Development’ Revisited. World Development 21:1787-1801.

Rosen, Stacey et al. 2012. International Food Security

Assessment, 2012-22. USDA, Economic

Research Service. http://www.ers.usda.gov/media/849266/gfa23.pdf

Sandrey,

Ron. 2006. The African Trading Relationship with China. Mimeo, Cape Town: Trade

Law Center for Southern Africa.

Scalapino, Robert A. 1964.

Sino-Soviet Competition in Africa. Foreign

Affairs. 42, 4:640-654.

Song,

Ligang, and Yongsheng

Zhang. 2010. Will Chinese Growth Slow After the Lewis Turning Point? China Economic Journal 3, no. 2:209-219.

Storey,

John. 1993. An Introductory Guide to Cultural Theory and Popular Culture.

Harvester Wheatsheaf: Hertforshire UK. p.119.

Taylor,

Ian. 1998. China’s Foreign Policy Towards Africa in the 1990s. The Journal of Modern African Studies.

36, no. 3:443-460.

Tsikata, T.M. 1998. Aid

Effectiveness: A Survey of the Recent Empirical Literature. IMF Paper on Policy

Analysis and Statement 98/1.

Wade, Abdoulaye. January 23, 2008.

Time for the West to practice what it preaches. Financial Times

http://www.ft.com/cms/s/0/5d347f88-c897-11dc-94a6-0000779fd2ac.html

- axzz3XKni2sux

York, Geoffrey. August 25, 2010. South African President

Heaps Lavish Praise on Authoritarian China. The

Globe and Mail. Toronto

Zemin, Jiang. 2000. Speech

by President Jiang Zemin of the People's Republic of China at the Opening

Ceremony of the Forum on China-Africa Cooperation Ministerial Conference

Beijing.

http://www.focac.org/eng/ltda/dyjbzjhy/SP12009/t606804.htm